Lesson Objective: Understanding Theta in options trading

“Theta” (ϴ) measures the time decay of an option i.e., the decrease in an option’s value for every day that passes by (all else being equal). Theta can be of any value, either positive or negative. Long calls and long puts always[1] carry negative Theta (because time only moves in one direction and the option holder has less and less time to be “right”) while short calls and short puts always carry positive Theta.

For instance, if Theta is 0.2, then the value of the option will theoretically decrease by $0.2 between now and tomorrow due to the sole effect of the passage of time. The holder of that option will see a -$2 change in his brokerage account while the seller of that option will see a +$2 change in her brokerage account (all else being equal).

Theta is represented as an actual dollar amount and may be calculated on a daily or weekly basis. Theta is the only “Greeks” variable that you can count on in terms of its direction: it will increase (in terms of absolute value). As such, Theta always favors the option sellers’ positions and hurts the option buyers’ positions, which is another reason why option sellers have generally an edge vs. option buyers.

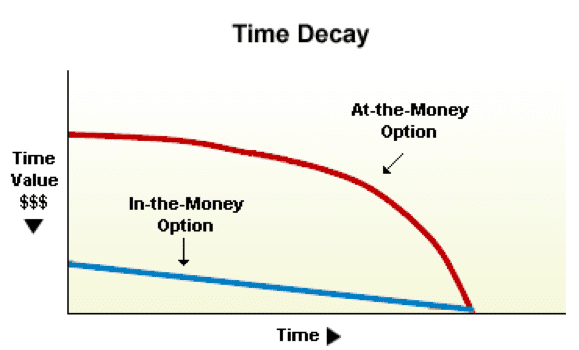

However, time decay is not linear. The amount of decay indicated by Theta is fairly gradual at first and then accelerates as expiration approaches. At expiration, Theta has robbed the option of all its time value (see our lesson on ‘Moneyness’) and consequently, there is no extrinsic value left. Note that pricing models and market makers take into account weekends and holidays, so options will typically decay seven days over the course of five trading days with more decay usually happening on Thursday and Friday in anticipation of the weekend. However, there is no standard industry-wide approach for decaying options based on the passage of time, so different models will provide different impacts of time decay.

As a general rule, the more time that remains until expiration, the greater the time value of the option. This makes sense given that long option traders are willing to pay a higher premium since the option will have more time to turn in-the-money (“ITM”). Conversely, the less time that remains on an option, the less premium traders are willing to pay due to a lower probability of the option being ITM at expiration.

Therefore, longer term options (“LEAPS” – Long term Equity Anticipation Securities) for instance carry a very small Theta as they do lose very little time value on a daily basis. Conversely, Theta goes up dramatically for all options as they near expiration.

The graph below is typically given to illustrate the fact that Theta is not linear and starts accelerating between 30 to 60 days prior to expiration for ATM options. In fact, Theta decays the most for ATM options in the last 30 days to expiration. Indeed, the time factor is critical for ATM contracts as they are constantly at risk of swinging into OTM territory. Conversely, options that are either deep-in-the-money or far out-of-the-money will have very little decay as they have less time premium since their status is more deeply “entrenched” and less liable to change.

Note that when you have more than one leg for an option strategy, the overall time-decay is the sum of the individual thetas for all positions. This is also true for calculating the Theta on an overall portfolio of options. If the portfolio includes long (or short) equity positions, these positions have no Theta value associated to them since equity positions don’t expire as options do.

We mentioned in the lesson on “Meet the Greeks” that the “Greeks” variables interact with each other and understanding their relationship is essential.

In general, the higher the implied volatility levels, the higher the Theta amount. This is due to the fact that the time value (or extrinsic value), of which implied volatility is a component, is higher and that these type of option contracts have more extrinsic value to lose per day.

[1] At least in the case of American options which we trade in the vast majority of cases.