Lesson Objective: Understanding Gamma in options trading

“Gamma” (Г) is a second-order Greek that measures the sensitivity of Delta in response to changes in the price of the underlying. In other words, it indicates how much Delta will change relative to every one-point price change in the underlying. Gamma allows us to analyze Delta and its expected rate of change in response to changes in the price of the underlying.

As a second-order Greek, Gamma is always a positive number for long call and long put options and always a negative number for short call and short put options, which means that Gamma will help buyers of options and will work against sellers of options.

If Delta is the vehicle’s speed, then Gamma is the acceleration factor, i.e. the rate at which the speed (Delta) changes. Higher Gamma values indicate that Delta could change dramatically in response to even small movements in the underlying’s price.

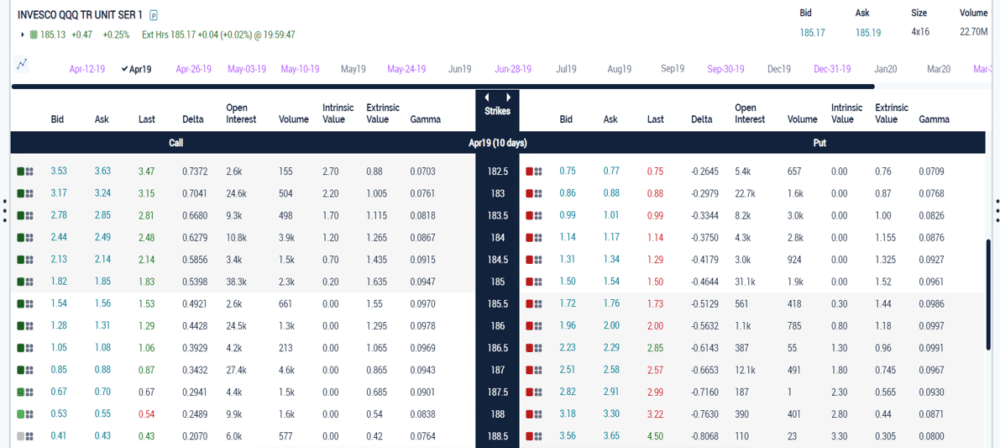

For instance, look at the QQQ Apr 2019 $185 Put (at-the-money) option that sells for $1.50 below ($150 for the 100 share-contract) while the price of QQQ is at $185.13. Delta is currently equal to -0.4644, which means that if the price of QQQ moves up by $1 then the price of the put contract will decrease by $46.44 (to $103.56) , all else being equal (and the opposite is also true if the price of QQQ moves down by $1). However, Delta itself is dynamic and that’s where Gamma can provide some useful information. Gamma predicts the next value of Delta due to another move in the underlying.

As you can see from the chart above, Gamma is currently at 0.0961 for the QQQ Jun 2019 $185 Put option, which means that the next time the price of QQQ moves up by $1, Delta will theoretically change to -0.5605 (-0.4644 – 0.0961) i.e., it will accelerate by 0.0961. As a consequence, if QQQ rises another subsequent $1, the price of the QQQ Jun 2019 $185 Put option will decline by $56.05 (to $47.60) instead of the prior $46.44 decrease.

Because Delta can never be higher than 1 or lower than -1 (see lesson on Delta), the deeper an option becomes ITM, the closer to zero Gamma gets. This makes sense since the price of an option that is very deep in-the-money will be far less sensitive to a $1 move in price of the underlying than an option that is ATM.

As a matter of fact, Gamma is at its highest when the strike of the option is near the current market price of the underlying (Delta is in the “vicinity” of 0.5 i.e., option close to being at-the-money). Again, one can intuitively see how an option that is ATM could be very sensitive to a $1 move in the price of the underlying since this move alone would make the whole difference in terms of whether the option is ITM or OTM.

Similarly, the closer you get to expiration the more “explosive” Gamma becomes for ATM options. This is due to the fact that the option could turn from ATM to ITM or from ATM to OTM in a split second, and there would be less and less time left for the option to escape its fate. In other words, Gamma can quickly turn winning trades into losers, or losing trades into winners.

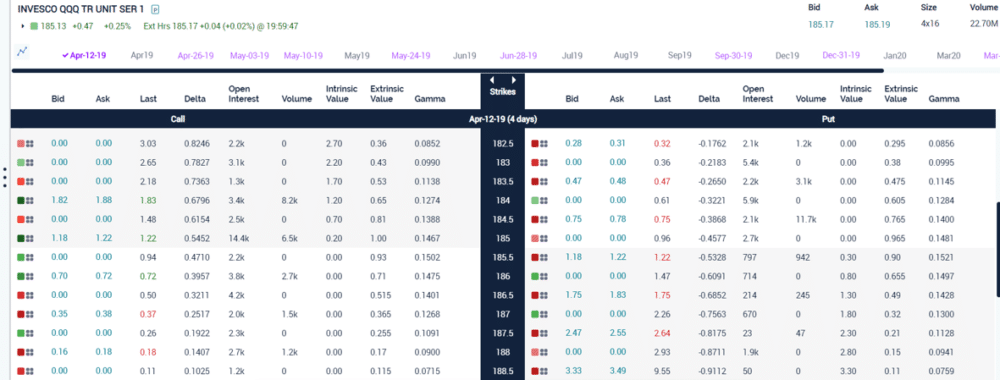

Look at the pricing table below and compare the Gamma for a near-ATM option at $185.50 but with an expiration date of 12 Apr 2019 (4 days left instead of 10).

The Gamma value of 0.1521 is quite significant and suggests that the current price of the option ($118) would first decrease by $53.28 (Delta of -0.5328 x 100) for the next $1 increase in the price of QQQ (from $185.13 to $186.13), and then by $68.49 ($53.28 + $15.21) for another $1 increase in the price of QQQ (up to $187.13), which means that the price of the option would fall to $3.77 (all else being equal) or close to zero.

This “catastrophic” collapse of the price of the option is due to the fact that the expiration date is now just around the corner, and once the price of QQQ has reached $187.13, the option is behaving as if it was far OTM – so almost worthless – given the little time left until Apr 12th 2019.

As you can see Gamma (“the Acceleration Force”) works hand-in-hand with Theta (“the Time Dimension”) but they favor different sides of the trade: Gamma works for the option buyer and against the option seller while Theta works for the option seller and against the option buyer. You cannot get one without the other. If you are a net option buyer, Gamma will be on your side but you will have to watch for Theta and try to limit time decay as much as possible. On the other hand, if you are a net option seller, Theta will be on your side but Gamma will represent a significant risk for your position especially if your options are ATM and the expiration date is approaching.

As with options that are deep ITM, Gamma will be far less significant for options that are so far OTM (Delta close to zero) that almost any change in the price of the underlying will have little effect on the price of the option itself.

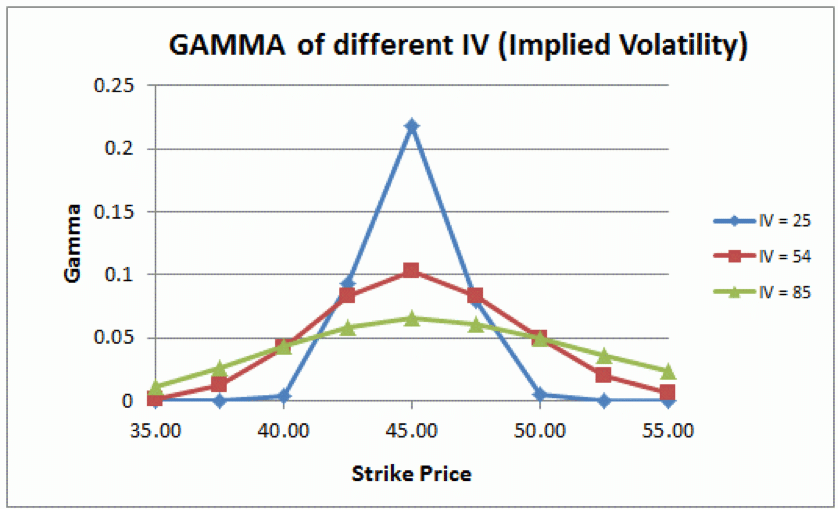

Finally, implied volatility changes will also have an effect on Gamma especially for ATM options (remember that deep ITM and far OTM options have low Gamma). When implied volatility decreases, the Gamma of ATM calls and puts will become relatively higher, and vice versa. This occurs because when IV is low, the extrinsic (time) value portion of an option is low, and therefore a change in the price of the underlying will have a more dramatic impact on Delta and the option’s intrinsic value component (proportionally speaking). On the other hand, an underlying with a high IV will have a relatively lower Gamma for ATM options because their extrinsic value is more substantial and therefore a change in the price of the underlying will have a less dramatic impact on Delta (proportionally speaking).