Lesson Objective: Learning the fundamentals of buying calls

When to buy calls: Generally, when you expect the stock to go above and beyond the combined value of the strike price and premium you paid to buy the option.

Buying a call means you buy an option to buy 100 shares of (1) a stock of your choice at (2) a strike price of your choice (3) before an expiration date of your choice. Since you buy the option, you are said to be “long” the call.

Let’s take an example: You buy XYZ 21 Jun 2019 $100 Call for $2. What does that mean?

It means that you buy (i.e., you are long) an option to buy 100 shares of XYZ at the $100 strike before the 21 of June 2019 by paying $2 per share now (i.e., for a total cost of $200).

If the stock price went above $100 before expiration, you could exercise your option, buy the stock at $100 from the seller and immediately resell it on the market for its higher value, thus starting to recoup some or all of your initial $2 outlay and possibly more. So, your basic assumption is that the value of XYZ will increase (well) above the $100 strike price before expiration, in fact above $102 (strike + premium paid) at a minimum so that you can breakeven.

In finance jargon, you buy a call if you are “bullish” (or very “bullish”) on XYZ.

On the other hand, a long call expires worthless when the stock price is below the strike at expiration: any rational person could and would buy the exact same stock at a cheaper price from the market rather than at the strike (and higher) price from the seller of the call.

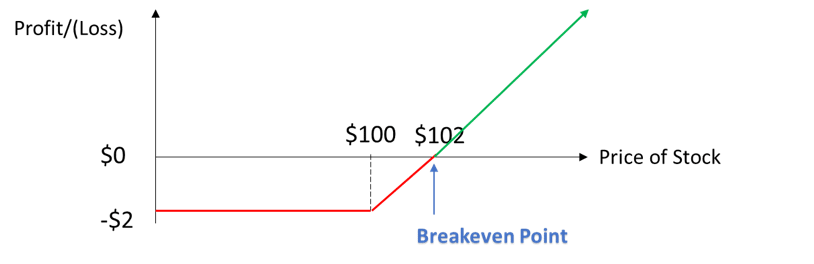

The best way to see how you would perform by buying a call is to look at the payoff diagram of a long call also known as the Profit and Loss chart:

As you can see above, if the stock is trading below $102 (strike + premium paid) at expiration, you lose money (the section of the graph in red). At $102, you breakeven. And above $102 you make money (the section of the graph in green).

The good news is that your loss is capped at $2 (per share) – the premium you paid – if the stock trades below $100 at expiration. Had you bought the stock itself rather than the option, you could have lost up to $100 (the total value of the shares) instead of just $2 (your option premium).

The bad news is that you would lose 100% of your investment (the whole premium) in this case. Again, had you bought the stock itself rather than the option, it would be very unlikely that you would lose 100% of your investment since share prices rarely plunge to $0 (except for exceptional events like Enron or Lehman Brothers…).

On the other hand, your gains are not limited and can theoretically go to infinity.

Be aware that looking at the graph alone may give the wrong impression that buying calls is a great strategy since your losses are limited but your gains are unlimited. In reality, buying calls can be risky trades since you could lose 100% of your investment (the premium you paid) as we just discussed, which would be the case if you were wrong on the direction at expiration.

In addition, as the holder of the option, time works against you. Why? Think about it: if you are given the option to buy a stock at a set price, the more time the stock has to potentially rise above the set price, the more the option is valuable to you. In other words, as time goes by, the value of your option goes down, all else being equal. At expiration any unrealized losses would automatically turn into real losses. When you own the stock itself rather than an option on the stock, any unrealized losses can usually be turned into profit if you can afford to wait long enough (provided that the stock is not definitely impaired due to severe stock-specific hardships).

Let’s sum up what we have learned so far:

| Outlook on Stock | Premium | Loss Zone and Maximum Loss | Breakeven | Gain Zone and Maximum Gain | Requirements to be Profitable | |

| Buying a Call

|

Bullish/ Very Bullish | You pay the Premium | Stock Price < Strike + Premium paid

If Stock Price < Strike => option ends worthless Max loss limited to the premium paid (when Stock Price ≤ Strike) |

Stock Price = Strike + Premium paid | Stock Price > Strike + Premium paid

Max gain unlimited |

Generally speaking, you must be right on the direction by a margin large enough to cover for the premium paid. |