Lesson Objective: Understanding Bear Call (Credit) Spreads

| Category | Description | Example |

| Key Components | a) Short call

b) Long call with a higher strike |

1) Sell XYZ Jun 20xx $100 Call for $5

2) Buy XYZ Jun 20xx $105 Call for $2 |

| Why Use Bear Call Spreads? | The bear call credit spread gives the seller the opportunity of receiving some income upfront why limiting the overall risk. Both the premium received and the risk exposure are less significant than in the case of selling a naked call.

The risk/reward profile of the bear call spread is similar to the one of the bear put spread even if you are receiving a net credit rather than paying a net debit upfront. Therefore, someone would typically use bear call spreads over bear put spreads if they prefer the idea of receiving a credit rather than paying a debit (again, in reality the risk/reward profile is very similar). Another argument would be when the implied volatility of the underlying is historically high as net option sellers usually have an edge in such a case (see lesson on Implied Volatility). An additional advantage compared to the bear put spread is that you would also make money if the underlying moves sideways since you received a net premium upfront. However, your maximum profit is limited to the premium received. |

Price of XYZ at $100

1) Sell XYZ Jun 20xx $100 Call for $5 2) Buy XYZ Jun 20xx $105 Call for $2 Net credit received: $3 = $5 – $2 |

| When to Use Bear Call Spreads (outlook)? | When you are moderately bearish on the underlying, hence the term “bear” call spread. If you were really bearish you would buy an outright put instead. You could also make some profit if the underlying moves sideways so this is a neutral to negative outlook type of strategy. | |

| Main Risks or Drawbacks of Using Bear Call Spreads | The main risk is for the underlying to rise above the breakeven price by expiration. You usually have a slightly wider risk than in the case of the bull put spread since your risk is not limited to a premium paid but rather to the width of the strikes of the spread minus the credit received. | |

| The Set Up | A bear call credit spread is a type of vertical spread. A vertical spread involves the purchase and the sale of calls (or puts) on the same underlying, with the same expiration but with different strikes. The term “vertical” comes from the position of the strike prices (typically one on top of the other) as can be seen on the screen of a broker’s platform.

In the present case, you will have to decide what strikes to select for each call, which warrants a trade-off between different parameters: (1) the premium you wish to receive upfront, (2) the maximum risk you are willing to take (i.e., the width of the strikes), and (3) the probability of success (i.e., probability of making any profit), which is usually provided on your broker’s platform. |

|

| Net Credit or Net Credit? | As a net seller of options, this strategy is established for a net credit. | |

| Maximum Profit | Maximum profit equals the net premium received. It is reached if the price of the underlying is at or below the strike of the short call at expiration. | 1) Sell XYZ Jun 20xx $100 Call for $5

2) Buy XYZ Jun 20xx $105 Call for $2 Maximum profit of $3 ($5 – $2) per share if the price of XYZ is at or below $100 at expiration. |

| Breakeven Price | Strike of the short call plus net premium received | 1) Sell XYZ Jun 20xx $100 Call for $5

2) Buy XYZ Jun 20xx $105 Call for $2 Breakeven at $103 ($100 + $3). |

| Maximum Loss | The maximum loss equals the distance between the strike of the long call less the strike of the short call minus the net premium received. It is reached if the price of the underlying is above the strike of the long call at expiration. | 1) Sell XYZ Jun 20xx $100 Call for $5

2) Buy XYZ Jun 20xx $105 Call for $2 Maximum loss of $2 [($105 – $100) – $3] per share if the price of XYZ is at or above $105 at expiration. |

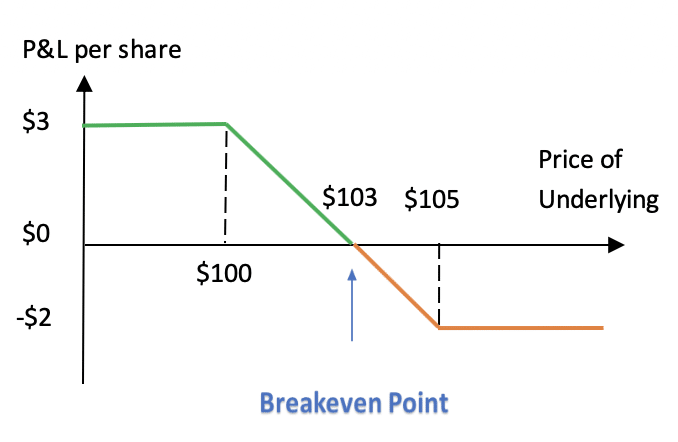

| Profit and Loss (P&L) Chart at Expiration | The P&L chart graphically represents the risk profile of a strategy.

|

· Sell XYZ Jun 20xx $100 Call for $5

· Buy XYZ Jun 20xx $105 Call for $2

Note: · The maximum profit of $3 ($5 – $2) if the price of XYZ is at or below $100 at expiration · The breakeven point at $103 · The maximum loss of $2 if the price of XYZ is at or above $105 at expiration. · Risk/reward ratio: 0.67 or 2-to-3 ($2 max loss / $3 max profit) |

| Effect of Price Movements | The overall position will benefit if the underlying declines, moves sideways (around $100), or even slightly up as long as it stays below the breakeven price ($103) so that it has a slight net negative Delta.

On the other hand, if the underlying rises above the breakeven price of $103, the overall position will lose value at expiration. |

|

| Effect of Time | The significance of time decay will depend upon the distance of the underlying from the strikes of the bear call spread.

Recall that long calls and long puts almost always carry negative Theta (because time only moves in one direction and the option holder has less and less time to be “right”) while short calls and short puts almost always carry positive Theta. If the underlying is below or near the strike of the short call, then the value of the spread depreciates (you make money) with the passing of time because you hold a net short position and the (near-the-money) short call is eroded by the passing of time at a faster rate than the OTM long call (all else being equal) so, you would carry a net positive Theta. Conversely, if the underlying is above or near the strike of the long call, then the value of the spread appreciates (you lose money) with the passing of time because the (near-the-money) long call is eroded by the passing of time at a faster rate than ITM short call (all else being equal), so you would carry a net negative Theta. If the underlying is somewhat equidistant to the strikes, then time decay has little effect on the overall value of the spread as the respective impact on the calls will offset each other. |

|

| Effect of Volatility | Here again, the effect of implied volatility depends on where the underlying stands relative to the strikes of the spread.

Recall that long options have positive Vega while short options have negative Vega, and Vega is usually at its highest for ATM options because these options are more sensitive to changes in the volatility of the underlying. If the underlying is below or near the strike of the short call, then the spread will gain in value if implied volatility decreases because this will increase the value of the (near-the-money) short call faster than it will decrease the value of the OTM long call. Conversely, if the underlying is above or near the strike of the long call, then the spread will gain in value (you make money) if implied volatility increases because this will increase the value of the (near-the-money) long call faster than it will decrease the value of the ITM short call. If the underlying is somewhat equidistant to the strikes, then volatility has little effect on the overall value of the spread as the respective impact on the calls will offset each other. |

|

| Assignment Risk | While the long call has no risk of early assignment, the short call does have such risk. Early assignment is generally related to dividends, and typically takes place on the day before the ex-dividend date. In-the-money calls whose extrinsic value is less than the dividend announced have a high likelihood of being assigned. You can assess such risk by looking at the value of the corresponding put (on the pricing chart of your broker), which will provide a good approximation and more direct reading of the time value left in the short call. If the dividend is higher than the value of the corresponding put, then assignment is likely and action must be taken. | |

| Approval Level Required by Brokers | Usually, the trading of bear call spreads is authorized by brokers for most traders/investors since you have limited risk. However, this is a fairly complex strategy that require some proper risk management after the initial setup. | |