Making money on a consistent basis in the stock market requires you to identify and act on ‘signals’. Ideally these will complement your fundamental research. These markers can include news flow, trends, technical analysis as well as investor behavior patterns. All of these factors can affect the price movement of an options contract. Unusual options activity, where the trading activity on a contract is significantly higher than its average daily volume, is one of the ‘flags’ that you should keep an eye out for. But options volume should be considered alongside other indicators; don’t use this marker as your sole investing rationale. Making an investment decision should be based on a range of factors.

Trading Volume

Trading volume measures the trading activity of a type of security, typically on a daily basis. Because daily patterns can fluctuate (sometimes wildly!) it’s useful to know what the “average pattern” is. That is where the average daily trading volume (ADTV) comes in useful. It provides a useful benchmark of what the normal pattern is for a particular security over a set period of time (usually 20 days). Then, any significant variations from that benchmark are worth investigating.

Let’s take an example to illustrate this further.

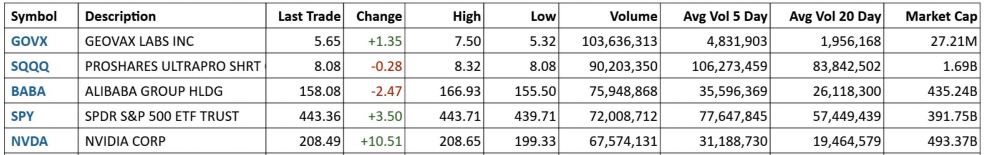

The following table summarizes the Top 5 securities with the highest trading volume at close of business on 20th August. Let’s take a closer look at trading volumes in GeoVax Labs:

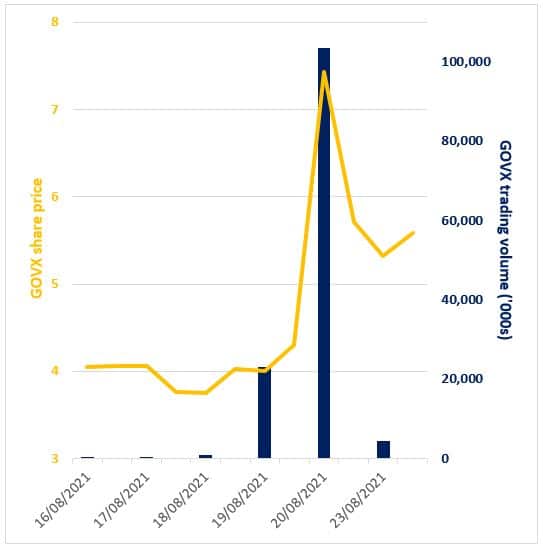

Trading volume in GeoVax Labs totaled 103.6M shares. Comparing this to the ADTV (5-day and 20-day averages) allows us to put this figure into context:

- 53x the 20-day ADTV (!!)

- 21x the 5-day ADTV (!)

This comparison with the 5- and 20-day ADTV shows us that the volume level on 20th August was clearly uncommon, and that a build-up in volume levels had been brewing in the preceding days.

As a result, this exponential surge in volume resulted in a significant uptick in the share price. The increase in volume was apparent in the buildup to August 20th.

Importance of Unusual Options Activity

If the trading volume is wildly significant compared to the ADTV then this is referred to as unusual options activity, and is worth taking a closer look at.

A spike in the trading volume of a specific security suggests that a large number of new positions are being taken (or that a big investor has taken a massive position!) – these can be either bearish or bullish positions. If the volume orders are sufficiently large, they can lead to big swings in the underlying. As a trader it’s your job to anticipate these kinds of moves and trade on them to your advantage. If the swing is significant and there are sufficient investors behind it, this will lead to a momentum trend which you can monetize if you got in early enough.

Many brokerage platforms and apps have features that allow you to track and screen for unusual activity in real-time.

Puts or Calls?

If you’ve identified that there’s unusual options activity going on, then the next step is to drill down an extra layer and understand the detail. For instance ask yourself if the market is mostly buying or selling? In puts or calls? And what is the rationale? The answers to these questions can hint to which direction the underlying security might go.

So…..Keep your eye on the volume!

👇 Learn more about trading volume on our Free Options course:

Lesson 44 – Volume and Open Interest

*******

Who are we? The Option Expert accompanies you on your options trading journey. We provide free education and generate trade ideas for our Members.

Our 2-step method:

1. Study the theory 👉 FREE options training course

2. Practice the trades 👉 Become a MEMBER and access our trade ideas

Check our 👉 Trading Performance 📊