Become the best option trader possible

A spreadsheet is an essential part of the toolkit that will help you become the best option trader possible. Keeping track of your trades in a detailed spreadsheet will help you improve your trading performance. Recording your trade details improves your strategy understanding, helps you manage your position and assess your available cash balance. Post-trade, your spreadsheet offers a precious track record which you can go back to and analyze to assess your weaknesses and strengths – this is key to improving future performance. Become the best option trader that you possibly can.

Spreadsheets vary in terms of their complexity as each trader will want to set theirs up differently. We’ve provided below a basic format intended to help you get started, and we encourage you to switch things around and add additional fields that are important to you. The key thing is for you to know your spreadsheet like the back of your hand so that you can navigate it rapidly and effortlessly.

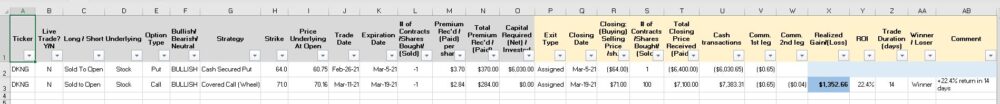

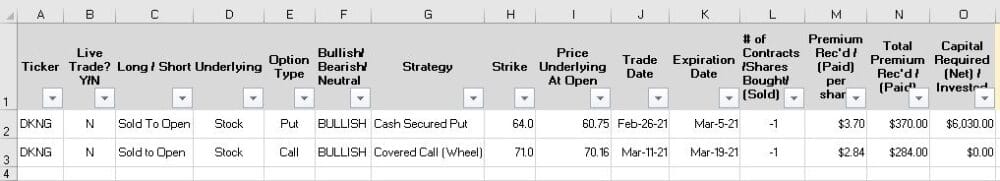

We’ve included an example of one of our trades to show you how to enter the details in Excel. Note that all the columns have filters to allow you to screen for certain specifics. Let’s take a closer look at the first part of our trading journal spreadsheet…

Ticker

This refers to the ticker symbol of the underlying on which your trade is based. Every underlying has its own unique ticker symbol by which it’s recognized on the stock exchange. In our example, we placed a trade on DKNB which corresponds to DraftKings.

Live Trade Y/N?

If you decide to store all your trades (both live and closed) in one same spreadsheet, you may find it helpful to identify their status with a simple ‘Y(es)’, or ‘N(o)’. Then you can simply filter out the types you don’t want to look at when it suits you, e.g., to only view your live trades.

Long/Short

Here you can specify whether this is the long or short leg of a trade. In our example we ‘Sold to Open’ (STO) the trade1

Underlying

You may want to keep track of the type of underlyings that you are trading, e.g., stock or ETFs

Option Type

This refers to the type of option contract, e.g., put or call2

Bullish/Bearish/Neutral

If you decide to keep a detailed account of your strategies you may want to include information on whether they were bullish, bearish or neutral.

Strategy

Keeping track of the different types of strategy will allow you to better analyze post-trade which ones you’re better at, and which ones you can improve on. In our example, we used a Wheel Strategy which consisted of selling a put, and then selling a covered call once we had been assigned the stock.

Strike

This refers to the strike price of the option contract.

Price Underlying at Open

It’s worth keeping note of the underlying’s price at the time you opened the trade.

Trade Date

Here you should record the date you opened the trade

Expiration Date

This corresponds to the expiration date of your trade. Applying a filter here is helpful, especially when you have a lot of trades, to avoid getting caught out by an expiring contract.

# of Contracts/Shares Bought/(Sold)

Here you should indicate the number of contracts (or shares) that you’ve bought or sold. The norm is to use negative numbers for contracts sold, and positive ones for the contracts you’ve bought.

Premium Rec’d / (Paid) per share

Keep track of the premium per share that you received (if you sold) or paid (if you purchased). In our example we sold 1 put contract on DKNG for which we received $3.70/share.

Total Premium Rec’d / (Paid)

Here you should note the total amount of premium received/paid. Referring back to our example, we received a total of $370 for selling 1 put contract since 1 option contract controls 100 shares (of DKNG in our example). Learn more about Option Basics in our FREE lesson: What Are Options Exactly?

Capital Required (Net) / Invested

Keeping track of your cash balance is important, as you need to know if you have enough to ‘cover’ live ones, and if you can afford to put on new trades. You should NEVER extend yourself. Read more about this in Lesson 16 – Capital Reserves.

This is why it’s important to keep a tally of what each position’s ‘worst case scenario’ could cost you. In our example, we ensured that we had $6,030 set aside (ex-commissions) in case our short put on DKNG was assigned. $6,030 represents the difference between the strike and the premium received for our short put.

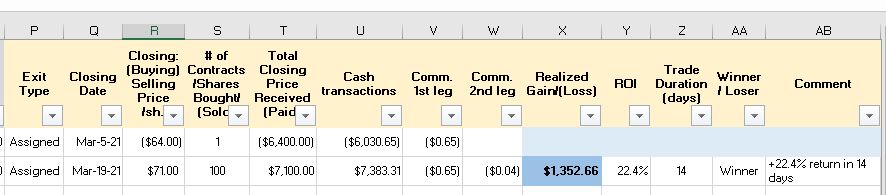

Exit Type

It’s worth recording how you exited the trade, e.g., were you assigned? did the trade expire, etc.?

Closing Date

Here you can record the date at which you exited the trade

Closing: (Buying) Selling Price /sh.

This refers to the price at which your trade was closed. In our example we were assigned at the strike price of $64.

# of Contracts/Shares Bought/(Sold)

In our example we were assigned 1 option contract.

Total Closing Price Received (Paid)

In our DKNG example our assignment required us to purchase $6,400 worth of DKNG stock (100 shares at a strike price of $64)

Cash Transactions

To keep an accurate tally of our cash balance, you should record your actual cash transactions. In our example, actual disbursements cost us $6,030.65 ($6,400 assignment, less $370 premium received, plus $0.65 commissions)

Commissions

You may want to keep track of the commissions paid, particularly if your brokers’ fees are high

Realized Gain/(Loss)

Keeping track of your realized gains/losses at an individual trade level will help you with your post-trade analysis

ROI

Here we record our Return on Investment at a trade level, calculated as the Realized Gain/Loss divided by the Capital Required/Invested.

Trade Duration (days)

This refers to the duration of the trade.

Winner/Loser

You may want to detail which trades which were successful and which weren’t so that you can go back and analyze.

Comment

It’s always good to make a few notes that you can go back to later on. Here we highlighted that the trade represented a 22.4% return in 14 days. You could also add a note on how you came up with the idea of this specific underlying or strategy (did you read a blog? Did you talk to a friend? Was it from an alert that you received?)

You can also add other fields like ‘industry’ or ‘sector’, which would give you a snapshot of how well diversified your portfolio is.

1 You can learn more about the different ways to open and close a trade in our FREE lesson:

Lesson 18 – Reading an Option Pricing Chart

2 Learn more about selling puts

*******

Who are we? The Option Expert accompanies you on your options trading journey. We provide free education and generate trade ideas for our Members.

Our 2-step method:

1. Study the theory 👉 FREE options training course

2. Practice the trades 👉 Become a MEMBER and access our trade ideas

Check our 👉 Trading Performance 📊